Essential documentation for a successful irmaa appeal

Wiki Article

A Comprehensive Overview to Browsing IRMAA Brackets and the Appeal Process

Navigating the intricacies of the Income-Related Monthly Adjustment Amount (IRMAA) can be a complicated job for Medicare recipients. Comprehending exactly how earnings thresholds influence premiums is important for effective monetary planning. Several people might not realize the implications of higher earnings on their medical care costs. As they discover the subtleties of IRMAA and the appeal procedure, they might reveal important approaches to handle their expenditures extra successfully. This guide will light up the path ahead.Comprehending IRMAA: What It Is and Just how It Works

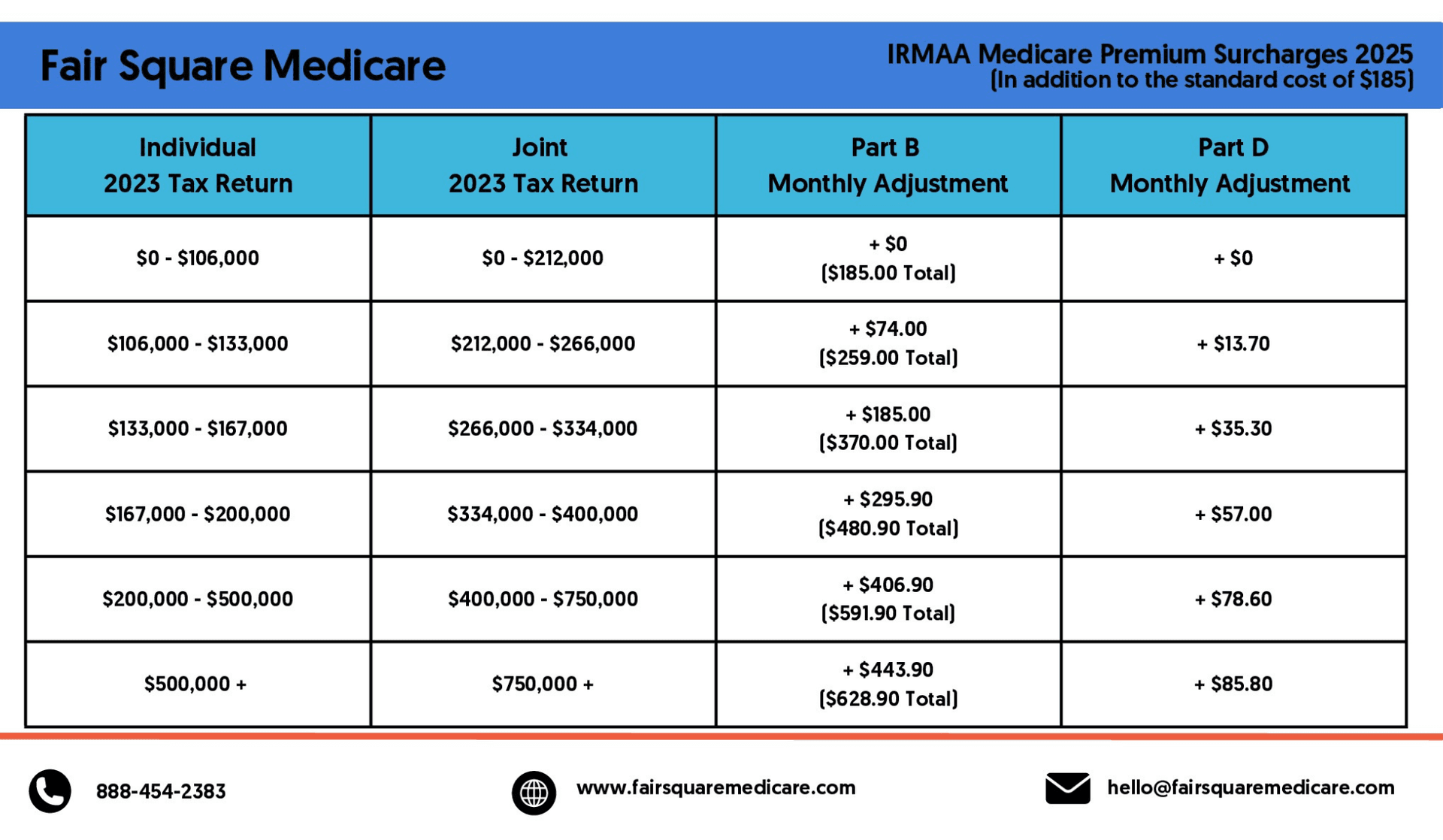

The Income-Related Monthly Adjustment Amount (IRMAA) is a crucial element of Medicare that impacts beneficiaries with greater earnings. This adjustment is designed to make certain that individuals that gain above a specific threshold add more in the direction of their Medicare Part B and Part D premiums. The IRMAA operates a moving scale, indicating that as a beneficiary's revenue boosts, so does their costs quantity. This approach aims to promote equity in the Medicare system by distributing prices according to earnings levels.The Social Safety and security Administration establishes IRMAA based on the recipient's changed readjusted gross revenue from two years prior. If people locate themselves encountering an unanticipated rise in their costs due to IRMAA, they may have alternatives for charm. Comprehending the subtleties of IRMAA is crucial for recipients, as it directly affects their regular monthly health care costs and monetary planning pertaining to Medicare protection.

Income Braces and Their Effect on Medicare Premiums

While several beneficiaries count on Medicare for essential healthcare coverage, income braces dramatically affect the premiums they spend for Component B and Component D. The Centers for Medicare & & Medicaid Services (CMS) develops these braces based upon customized adjusted gross income (MAGI) from two years prior. As beneficiaries' income levels climb, so do their premiums, commonly leading to higher prices for those gaining over particular thresholds.For 2023, people making over $97,000 and pairs earning over $194,000 face boosted premiums, with prices rising through different rates. This framework intends to guarantee that higher-income beneficiaries contribute more towards the expense of their protection. Recognizing these income brackets is crucial for recipients, as it straight affects their economic planning and health care accessibility. Recognition of just how income levels influence Medicare costs can assist beneficiaries navigate their choices and avoid unanticipated costs associated to their health care coverage.

Exactly How IRMAA Is Computed: A Detailed Malfunction

Recognizing exactly how IRMAA (Income-Related Monthly Adjustment Amount) is calculated is necessary for Medicare beneficiaries facing boosted costs. The calculation begins with the recipient's changed changed gross earnings (MAGI), which includes adjusted gross income plus tax-exempt interest. This income is analyzed based on the most recent tax obligation return, usually from 2 years prior.The Social Security Management (SSA) classifies beneficiaries into different IRMAA braces, each matching to a details MAGI variety. As earnings boosts, so does the costs modification, leading to greater monthly costs for Medicare Part B and Part D.

Recipients may locate their IRMAA amount on their Medicare Premium Costs. It is critical for people to stay notified concerning their revenue condition, as variations can influence their IRMAA calculations and inevitably their healthcare expenses. Recognizing these actions aids in efficient economic planning for Medicare beneficiaries.

Navigating the Appeal Process: When and Just How to Appeal IRMAA Determinations

Browsing the appeal procedure for IRMAA decisions can be a vital step for beneficiaries that believe their earnings assessment is wrong. Starting an appeal calls for comprehending the specific premises for objecting to the IRMAA choice, which commonly revolves around revenue inconsistencies or qualifying life occasions that may influence one's earnings degree. Beneficiaries should collect relevant documentation, such as tax returns or evidence of income adjustments, to validate their cases.The appeal has to be submitted in creating to the Social Safety And Security Administration (SSA) within 60 days of the initial determination. It is essential to adhere to the SSA's guidelines very carefully, including offering your Medicare number and clear information concerning the allure. When submitted, the SSA will examine the situation and alert the beneficiary of their choice. If the charm is unsuccessful, further steps, including a reconsideration request or a hearing, can be gone after to make sure all opportunities are explored.

Tips for Handling Healthcare Expenses Associated With IRMAA

As recipients deal with increased medical care prices appealing irmaa as a result of IRMAA, applying efficient techniques can help manage these expenditures extra effectively. First, evaluating one's income routinely is necessary; variations might qualify individuals for lower IRMAA brackets. Additionally, discovering alternatives such as Medicare Cost savings Programs or state aid can offer monetary relief.Recipients need to additionally take into consideration utilizing preventive solutions covered by Medicare to lessen unanticipated medical care prices - appealing irmaa. Engaging with doctor to talk about treatment strategies and possible options can even more decrease expenses

Making the most of using Health Financial savings Accounts (HSAs) or Versatile Spending Accounts (FSAs) permits tax-advantaged financial savings for clinical expenses. Beneficiaries must continue to be informed about modifications to Medicare plans and IRMAA limits, which can influence overall healthcare costs. By proactively taking care of these facets, recipients can mitigate the monetary worry connected with IRMAA.

Frequently Asked Concerns

Can IRMAA Impact My Social Protection Conveniences?

What Occurs if My Income Adjustments After IRMAA Determination?

If a person's income changes after IRMAA resolution, they might qualify for a lower premium brace. They can appeal the decision by supplying paperwork of the revenue adjustment to the Social Security Management for evaluation.Are There Exceptions for IRMAA Calculations?

There are limited exemptions for IRMAA computations, largely based on life-altering events such as marriage, divorce, or fatality of a spouse (security brackets). Individuals might require to supply documents to get approved for these exceptions throughout the evaluation processJust How Usually Does IRMAA Adjustment?

IRMAA changes each year, normally based on earnings changes reported to the IRS. These changes mirror rising cost of living and alterations in revenue thresholds, impacting people' costs for Medicare Component B and Part D annually.Can I Obtain Aid With IRMAA Payments?

Individuals might seek help with IRMAA payments with economic consultants, social solutions, or Medicare sources. Different programs exist to assist take care of costs, ensuring people can access essential medical care without unnecessary economic problem.The Income-Related Monthly Adjustment Amount (IRMAA) is a crucial component of Medicare that influences recipients with greater revenues. The IRMAA runs on a moving range, suggesting that as a beneficiary's earnings increases, so does their costs amount. The Social Safety and security Management identifies IRMAA based on the beneficiary's changed readjusted gross income from 2 years prior. Browsing the appeal procedure for IRMAA resolutions can be a critical step for recipients who think their earnings evaluation is incorrect. Starting an allure requires understanding the particular grounds for contesting the IRMAA choice, which commonly revolves around income disparities or certifying life occasions that might influence one's income degree.

Report this wiki page